Money is one of the things that you can guarantee will cause an argument. Some people have more money than they could ever possibly spend. However, many people are barely scraping by. In 2014, 46.7 million people in the United States were living below the poverty line. I plan to show you how raising the minimum wage in the US will not only bring people out of poverty, it will actually improve the current economic climate.

For those of you that don't know, the United States is a capitalist country. We thrive on the free market. Being able to choose where we spend our money is an American right! But, thanks to the Regan era, we are stuck in a wrong mindset. Many people seem to think that "trickle down economics," where giving benefits to the wealthy helps the rest of society, works. Well, it doesn't.

Capitalism is based on the theory that people will spend money on products. The economy needs people to have enough disposable income to keep it going. Instead of relying on the few wealthy people in society, we need the larger middle class to spend. The only way that will happen, though, is if they (and, to a lesser degree, the lower class) bring enough money into their households to pay for things like food and rent. We, as a society, need to make sure that these necessities can be covered so money can be spent on other, not-so-necessary things.

Let me give you a scenario: Bob attended college. He got his degree and is qualified to teach high school math. However, Bob can't find a job teaching. But Bob still has to eat and pay rent. (We'll be 'nice' and keep Bob single so he doesn't have to pay for diapers or baby food or daycare costs.) So Bob takes a job at his local grocery store. Bob barely makes enough money to feed and house himself. He can't afford a car or to have a meal at a restaurant or buy the nice pair of shoes.

This is the problem. Without Bob spending his money at other businesses, those businesses don't have the money to pay their workers. It is a vicious circle. However, if we paid Bob a little bit more, Bob would have some extra money he could spend on extra things. He could eat at the local restaurant, which would generate more money for the business, who could afford to pay their workers more. Then those workers would have extra money to spend at other businesses. And around and around and around.

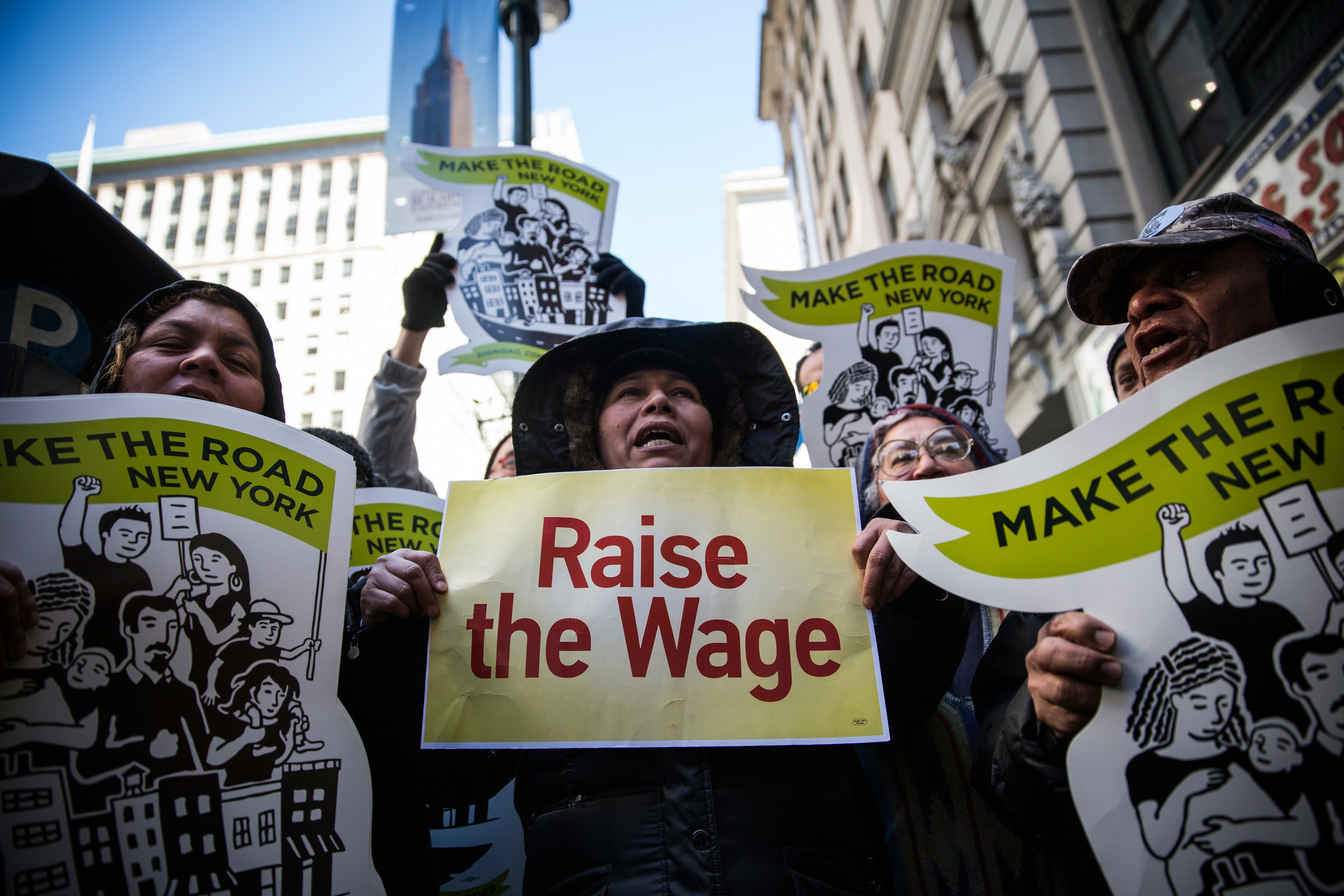

Thanks to the media, people think that the retail workers or fast food workers are nothing but lazy scum. They are not. They are hard working people like everyone else. Maybe they prefer retail work (someone has to help you buy that shirt or that microwave) or fast food (someone needs to cook those burgers if you want to eat them). That doesn't make them lazy. That makes them useful members of society. And we need to treat them as such. There is no reason that they shouldn't be paid a wage that will allow them to not only survive but thrive as well.

To those of who you think that raising the minimum wage would result in a $15 hamburger at McDonald's. You are wrong. Dead wrong. Capitalism survives on supply-and-demand. When demand is high and the supply is high, the cost is low. I don't forsee McDonald's running out of hamburgers any time soon. Instead, the demand will increase since now Bob can afford to buy a burger. If anything, prices will decrease because the demand will be that much higher.

But where do we get the money to start the process? I know this is very unpopular but those outrageous salaries of executives need to be cut. The CEO of CVS, Larry Merlo, makes a little over $24 million. If you cut that by 25%, that would give an additional $6 million that could be spread out over their lower-tier employees and, poor Mr. Merlo, would still have $18 million per year left. The same is true for all of the top executives.

We, as a society, need to stop believing that certain work is menial or beneath us. All jobs are necessary or they wouldn't exist in the first place. Now we need to stop treating the people doing those jobs as scum. They are people too and they deserve to be treated as such. They deserve to have good, healthy food and an apartment that isn't filled with cockroaches and rats. I wish I could say that it was simple selfishness. No, we are hurting ourselves more than we are helping. Sadly, it is nothing more than greed. And greed will be what collapses our economy.